Including the Momentum Factor as part of a “smart beta” strategy is proven over time to boost risk-adjusted returns.

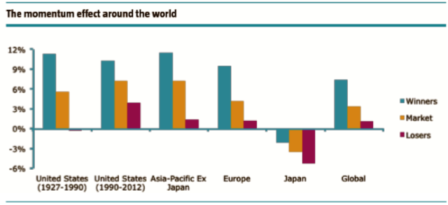

Smart beta ETFs seek to combine the best of active and passive investing by outperforming the market while keeping costs low. By adhering to rules-based methodologies, these ETFs remain transparent and easy to understand. Different risk factors perform differently across market cycles. That’s why it’s becoming more and more prevalent for institutions to construct ETFs that leverage the premia of various risk factors such as value, size, momentum and volatility. While a multi-factor approach is prudent, academic research suggests that the factor that demonstrates the best risk-adjusted returns is momentum. Momentum investing if handled with discipline based on a robust model can be hugely rewarding. A recent research paper, Fact, Fiction and Momentum Investing by Moskowitz, Asness and Israel (May 2014), shows that managers can improve the efficiency of their portfolios by incorporating momentum strategies. Including momentum to enhance smart beta portfolio construction can no longer be ignored.