WTI Crude has been on a steep downward trend, dropping over 75% in about 18 months. At the time of writing, WTI had recently hit a 12-year low, briefly dipping below $27 per barrel. As a result, Oil & Gas Produces, Equipment Service & Distribution companies have all seen sharp falls in their share prices. Performance like this can be particularly damaging to investor’s portfolios.

Smart Momentum analytics can spot negative trends early helping to limit downside capture and protect profits while improving risk control and portfolio performance.

This report will utilize Trendrating’s Smart Momentum analytics to explore momentum in Global Oil & Gas Stocks.

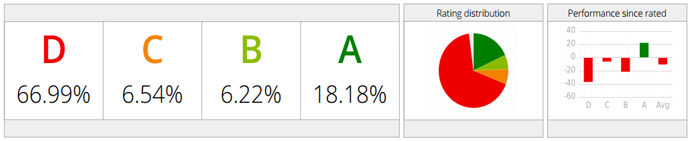

Below is the current distribution of momentum in this sector as well as the average performance of each rating:

As we can see from the diagram, nearly 73% of Oil & Gas stocks are currently exhibiting negative momentum. However, about 18% of stocks are in an established upward trend (A rated) and these have an average return (since rated) of about 20%.

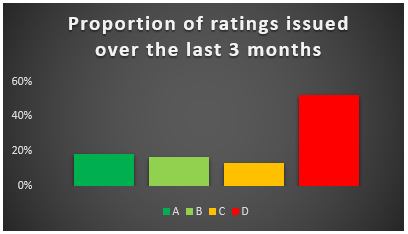

The chart above displays the Momentum Ratings changes issued by Trendrating over the last three months. We find that the vast majority, over 50% of issued ratings, has been for stocks entering established bear trends (D rating). These results are consistent for a sector in a long term negative trend.

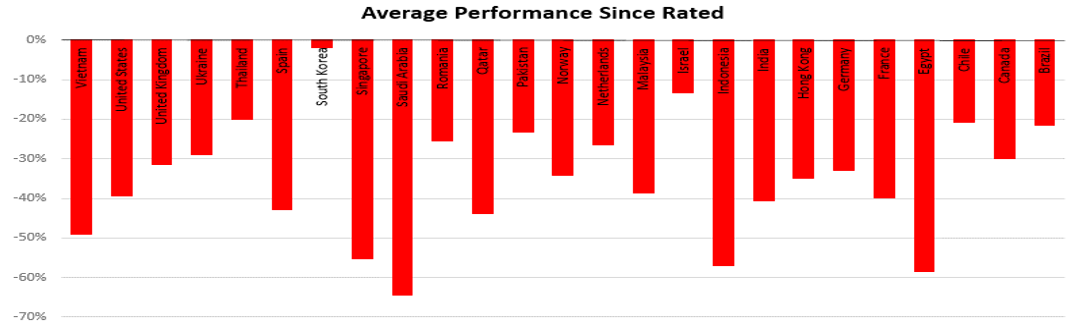

How widespread is the damage? From the chart below, we can see the average performance of Oil & Gas stocks for various countries, since individual stocks moved to a negative rating. The picture is not pretty. On average Oil & gas stocks are down 35% by this metric with Saudi Arabia, Singapore, Indonesia and Egypt leading the way down.

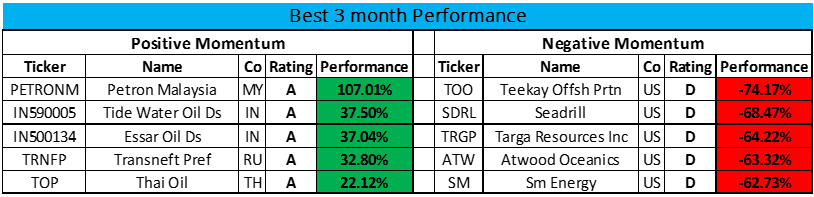

The Table below shows us a sample of A and D-rated Oil and Gas stocks and their current performance (since rated).

When we look at the 3-month performance of securities that have been rated for at least that period of time, we find that our best performing Oil and Gas stocks are in Emerging Markets while our worst performers are in Developed markets.

In conclusion, the performance of Oil and Gas stocks have tracked the price of oil downwards. Performance of this sector has been bad in most global markets. Despite this dislocation, Investors still seeking to invest in this sector will find that Emerging markets in Asia and Europe have the strongest positive momentum in a relatively negative momentum environment.