Actionable ratings to enhance performance and reduce portfolio risk

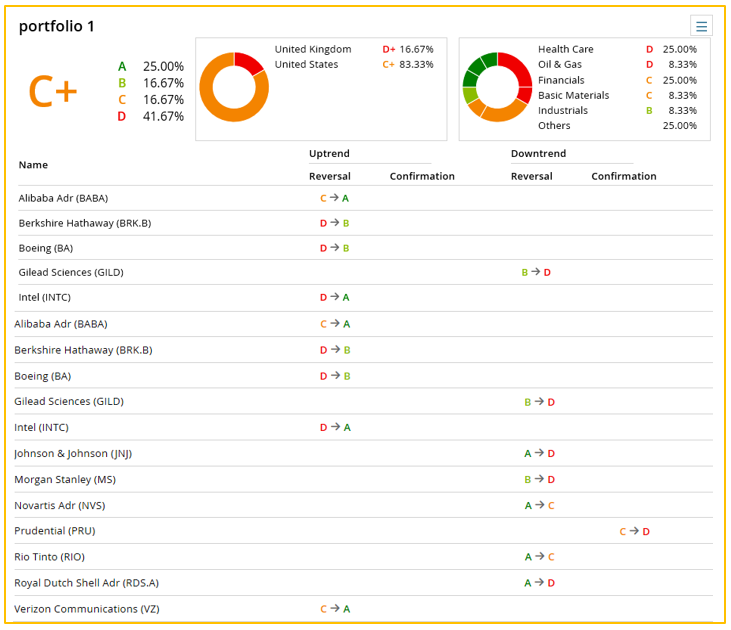

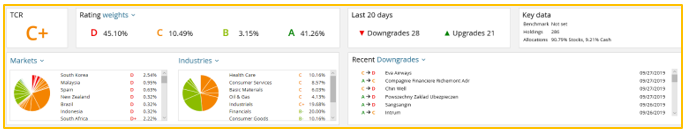

Wealth managers can now run aggregated portfolio analysis and immediately optimize strategies by limiting the exposure in underperforming stocks and ETFs.

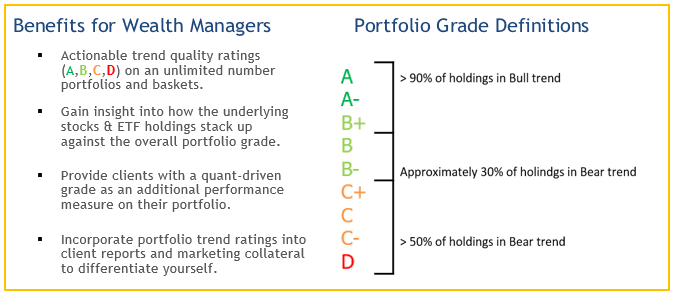

Portfolio managers typically use a common set of metrics to measure the aggregated risk-return profile of their holdings. This can include volatility, tracking error, Sharpe ratio, price earnings and dividend yields. Now with Trendrating, wealth managers can measure a portfolio in terms of the overall exposure to positive vs negative trends which can easily be combined with most investment strategies. Trendrating supports a more refined, granular analytics structure via a rating grade (A,B,C,D) that includes “pluses” and “minuses”. This methodology offers a comprehensive way to measure the aggregated exposure for whole portfolios and baskets. The resulting profile is calculated on all the components and the specific weightings and synthetized as a grade.

A methodology to monitor the portfolios exposure to positive vs negative price trends

Measure portfolio quality and identify areas of risk

Leverage our robust model to run regular health checks on entire portfolios to limit exposure in underperforming stocks and ETFs.

Identify stocks & ETFs that can negatively impact the performance

Reduce exposure on losers and improve the portfolio structure

Trends are the most important information to manage performance risks and maximize returns.

The ability to capture trends, profiting from bull markets and avoiding bear phases is the key to superior performance on a consistent basis. Investors that have a good understanding and a disciplined respect for the specific price trend of securities outperform competitors. Any investment strategy can be enhanced by a better synchronization to trends developments.

Trendrating provides advanced analytics designed to capture trends, identifying most of the winners and avoiding a large part of the losers with in a yearly horizon. It offers a well proven rating of trends where A and B indicate a bull trend and C and D mark bear moves. The result is a unique edge where A and B rated stocks on average outperform those rated C and D. These advanced analytics are a powerful complement to fundamental strategies and deliver alpha. Measurable, actionable, repeatable.

By Shiv Nathwani, Client Solutions – EMEA & Asia Pacific at Trendrating