Trendrating provides “Trend-Capture” technology to over 100 institutions and premier partners worldwide, adding objective discipline to Portfolio Management.

THE BACKGROUND

Recent studies highlight that over 80% of active managers in most regions have underperformed their benchmark over long-term time horizons. (Spiva Statistics, December 2018)

Portfolio Management is becoming more complex and challenging. Security price action is demonstrating an increasing disconnect with underlying fundamentals, resulting in long periods of underperformance for active managers.

The correlation between fundamental metrics and actual price performance has become weaker in a decade characterised by large scale asset purchase programs and market participants betting on a revival of economic growth. This is creating significant challenges for stock selection strategies. In equities, the increasing net flows into passive instruments and smart beta strategies are further excacerbating the inefficiencies in certain segments of the market.

We strongly believe, supported by our analysis and testing, that the ability to capture trends – profiting from bull markets and avoiding bear phases – is the key to superior performance on a consistent basis. Investors that have a good understanding and a disciplined respect for the price trend of securities have a greater potential to outperform competitors. Therefore, any investment strategy can be enhanced by having better synchronisation with trend developments.

As such, our mission is to help active managers fight back and prove to clients that they can outperform passive management strategies.

PORTFOLIO ANALYTICS

Portfolio analytics solutions are widely adopted by investors to navigate the capital markets and manage their portfolios effectively. Capital Markets CIO Outlook’s special edition on Portfolio Analytics recognised Trendrating amongst the Top 10 Portfolio Analytics Solution Providers for 2019.

Trendrating provides advanced analytics designed to capture medium to long-term trends, identifying stocks with a high probability to be winners and avoiding securities that may result in losses within a yearly horizon.

Using our proprietary model driven solution, Portfolio Managers, CIO’s and Risk Managers can expand their toolkit, deploying a layer of trend-capture analysis to enhance their often fundamentally driven approach.

Trendrating fills a critical gap of market intelligence by providing a methodology and a “performance management” system to support a better synchronisation with trends at individual stock, sector and market levels. Incorporating trend capture analytics into the investment process helps position portfolios to profit from early participation in strong uptrends and reduces drawdowns through early exits from strong downtrends.

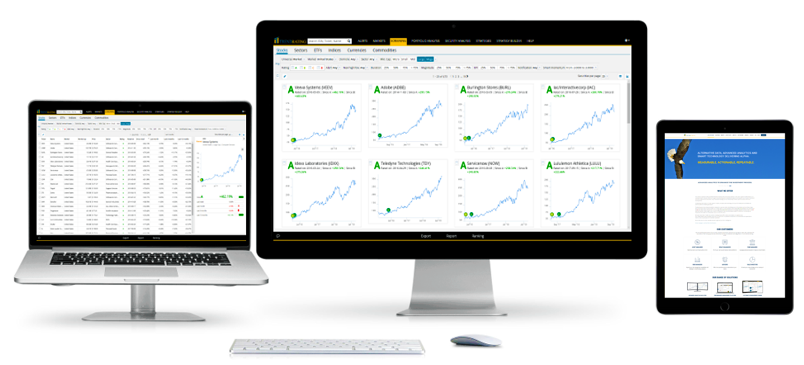

The approach combines robust and sophisticated trend-capture analytics within a web-based Performance Management system, offering functionalities designed for seamless integration into the portfolio management workflow. With Trendrating, global investors can count on a proven, well-validated methodology that provides an edge in identifying those trends that can make a material difference in annualised performance.

TRENDRATING ALSO OFFERS:

DATA FEED SOLUTIONS – Investment managers can incorporate the robust trend-capture model into existing platforms and internal systems.

SYSTEMATIC MANAGEMENT ENGINE – If your desire is to manage equity portfolios on a fully systematic basis, we have the technology for you.

STRATEGIC PARTNERSHIPS – Exchanges and market-data vendors seeking unique, powerful and actionable alternative data that can provide an edge.

PERFORMANCE MANAGEMENT SYSTEM

SCREENING & RANKING – Screen from over 20,000 listed securities – Stocks, ETF’s and Indices, Validate investment ideas and challenge analyst opinions, Rank your investment universe with an extra layer of intelligence and Focus on stocks that check all the boxes.

PORTFOLIO ANALYSIS – Control risks across all your holdings, Run a sanity check across all your portfolios via aggregated portfolio ratings, Get alerts on critical trend reversals and Prepare rich and compelling reports for client and investment committee meetings.

MARKETS – Perform macro analysis across markets and regions, Analyse, compare and rate sectors, Tactical allocation and Fine tune the allocation of sectors, markets and regions.

By Neil Kapadia, Business Development – EMEA & Asia Pacific at Trendrating