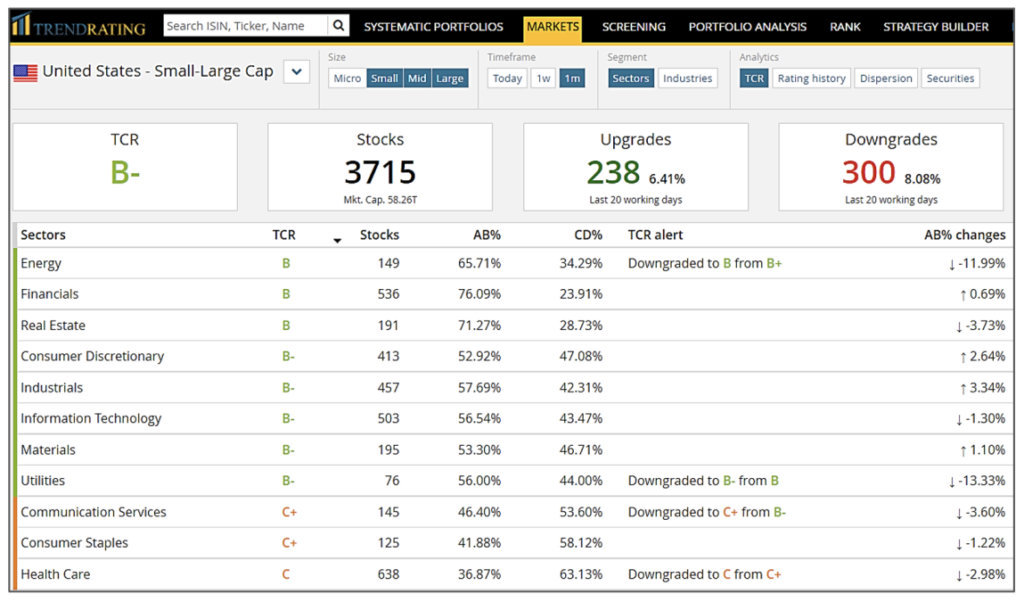

Vast Majority of U.S. Sectors Were Downgraded in the Past Month as Uncertainty Increases Due to Continued Pandemic and Supply Chain Problems

Markets disappointed in November after a strong October run. Most US Sectors experienced ratings downgrades with Utilities seeing the biggest shift to “C” and “D” ratings. The Trendrating model has detected a bear phase on 73% of the Large Cap stocks that have fallen the most. Performance dispersion generates risks and opportunities for active managers. The dispersion in the US Large Cap universe over the last 12 months ending November recorded an average return difference between the top and bottom quartiles of 102%. – Rocco Pellegrinelli, CEO of Trendrating

December Sector Allocations

Methodology

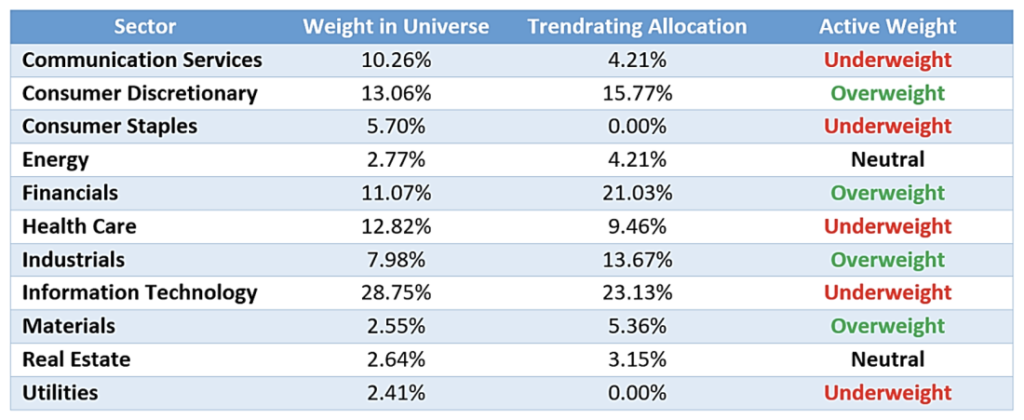

To arrive at our monthly Sector Allocations, we delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS). Any stock that has retraced at least 20% from a trend high is considered an outlier. The sector allocation is then found by looking at the proportion of names within quantile one for each sector. To control risk, no sector can represent more than double its weighting in the index.

December Allocations

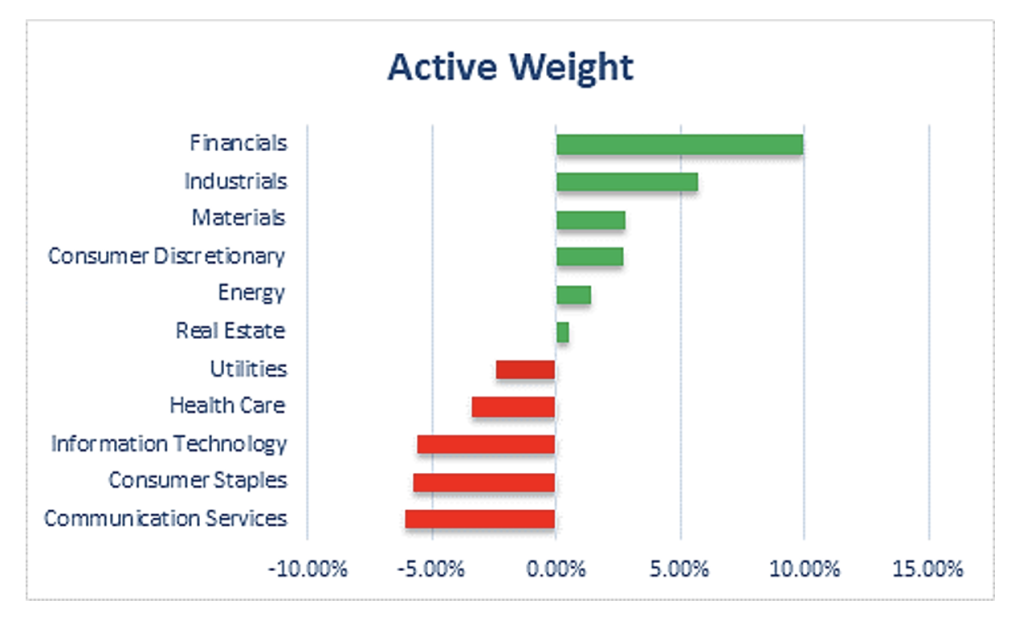

Over the last few months, the market has been driven by a handful of securities. The Trendrating model is heavily overweight Industrials, Consumer Discretionary, Financials and Materials. Conversely, Trendrating identifies the sectors with the weakest trends as Information Technology, Communication Services, Consumer Staples, Health Care and Utilities. We are neutral on Real Estate and Energy which have a deviation of less than +/- 2% from the index weighting.

U.S. Macro Market View – October to December

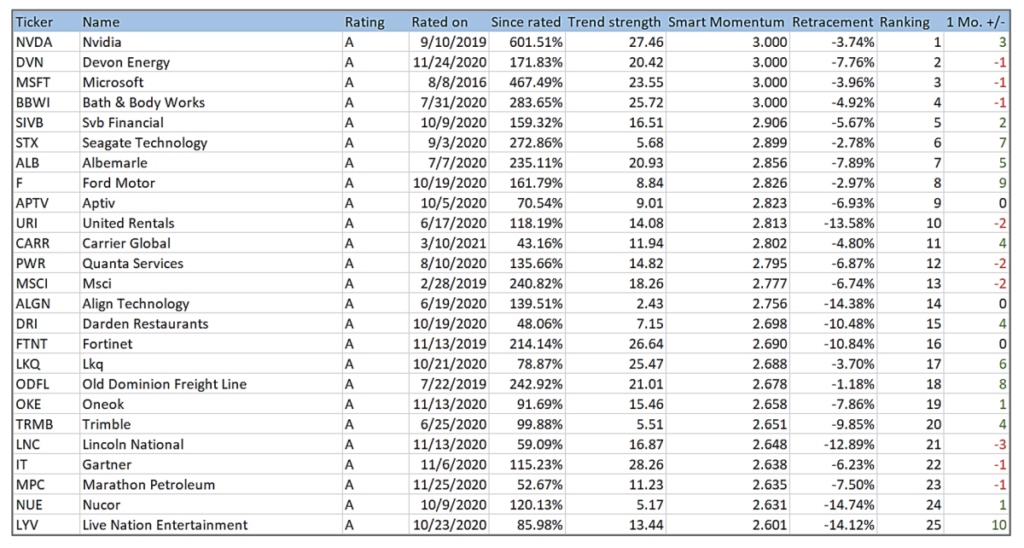

Top Trending Stocks in the S&P 500

Methodology

Each month we distribute the Trendrating 100 list to our clients. We delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS) and retracement value. Any stock that has retraced over 10% from a trend high is considered an outlier. This leaves us with a list of names in which our Model has high conviction. The market environment will dictate the number of names in the Top 100 list, but it will typically range from 80-100 companies. Here will be highlighting the Top 25 companies each month. Contact Trendrating for the complete list.

Trendrating Terminology

Rating Grade: A = Strong Bull Trend / B = Emerging Bull Trend / C = Emerging Bear Trend / D = Strong Bear Trend

Trend Strength: measures the consistency of the trend. The higher the value, the more the trend is developing consistently. The smaller the value, the greater the noise. The Trend Strength span in range [-30, +30]. The calculation considers the price history of the last 6 months. The 180 working days are divided into periods of 6 days. For each period, a value of +1 or -1 is assigned depending on whether the performance of the period is positive or negative.

Smart Momentum Score (SMS): is a continuous rating scale between -3 and 3, measuring the strength of the trend since that trend began. The metric allows the model to differentiate between securities of the same ratings, whether that is an A, B, C or D rated security.

Retracement: The percentage off the peak of the trend for positive trends or off the bottom for negative trends.

Additional Information:

Trendrating Use Cases – An overview of the services we offer

Trendrating Indices – Six Indices calculated daily and rebalanced monthly

ANY AND ALL INFORMATION PROVIDED BY TRENDRATING OR DERIVED FROM TRENDRATING’S DATA IS PROVIDED “AS IS” AND TRENDRATING MAKES NO WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. LEARN MORE ABOUT TRENDRATING AT WWW.TRENDRATING.COM OR CONTACT INFO@TRENDRATING.COM.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source: Nasdaq Inc.