The bull market is gone, and experts say that we are in a new market regime. A new cycle of low returns can last a few years, as historical data can confirm.

Returns from indices can prove to be volatile and erratic, but the performance dispersion across stocks offers the opportunity to perform by embracing some degree of active management.

We believe, to better understand how to succeed in the changed market cycle, it is critical to consider a few facts and find the answers.

- How broad is the performance dispersion across stocks?

- Which fundamental parameters can best decipher price trends and profit from dispersion?

- Can combining different parameters and checking more quality boxes enhance returns?

Our research team ran several tests to produce answers to these key questions. The analysis covers data as of October 20th for US large-cap stocks.

The Performance Dispersion Opportunity

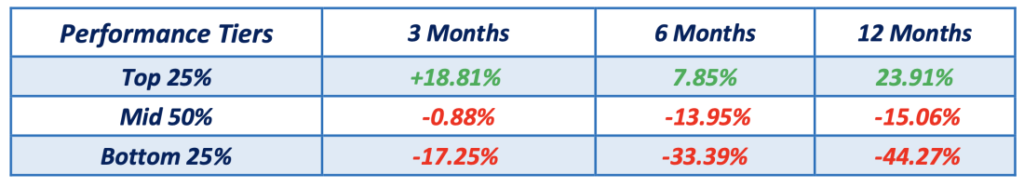

Performance dispersion is a repetitive fact in the stock market as the average performance table below shows. There is a good number of stocks that produced gains even during the relentless bear phase year-to-date.

Capturing some of the outperformers and avoiding most of the underperformers is the essence of successful investment strategies. The market is very selective and a comparative analysis of commonly used fundamental metrics can offer insights about what works better. Beyond assumptions, let’s analyze the facts.

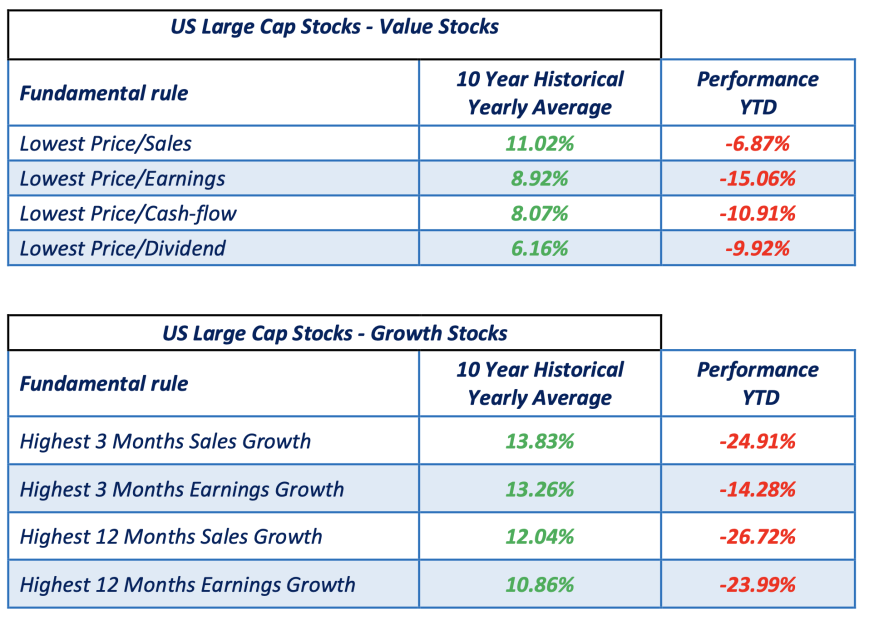

It is interesting to see the difference in performance across single metrics. The analysis uses the best quartiles with a quarterly rebalance.

Discovering the Impact of Combining Fundamental Rules

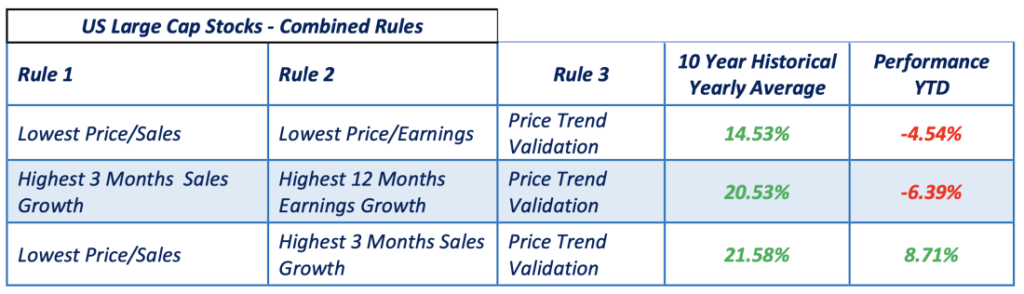

Is it possible to increase the performance using a combination of fundamental metrics that enables a better selection of stocks? We tested several combinations of rules with the goal to discover ways to better handle the new regime. The outcome confirms that checking more selected quality boxes can add value, as some example selection strategies performed better that the benchmark over a 10 year history as well as year-to-date.

Filtering Out Negative Price Trends Can Boost Performance

Price trends may not necessarily mirror the good fundamentals. A consistent selling pressure can overwhelm even the best analysis. Therefore, adding a layer of “trend risk” control that filters out falling stocks can contribute to improve returns.

Acknowledging and respecting trends is a safe practice.

The data below shows the potential impact of considering a pragmatic, logical trend validation.

We believe that the current market cycle calls for a reassessment of the investment strategies that worked during the bull market.

It’s best practice for financial professionals to invest in innovative, leading- edge analytics and tools that provides critical insights that enable money managers to design, test and optimise their strategies with no constraints in exploring ideas and discovering the best framework to succeed in the new regime.

Source: Nasdaq Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.