Based on our research, in 2022 we entered a new market cycle that is expected to generate low returns for the next few years. The previous similar market cycles (1968-1982 and 2000-2009) recorded annualized returns on major US indices that were below 1% with a long sequence of volatile up and down waves.

But while indices may go nowhere, the performance dispersion across stocks is broad and very prominent in this current new regime. For example, in 2022 the S&P500 posted a loss of around 18%, but the top 25% performers in the index exhibited an average gain of 20% while the bottom 25% lost on average 41%.

Active portfolio management can deliver superior returns even in a low return market cycle as long as the underperformers are avoided and portfolios are invested in some of the few strong performers. The challenge for investment managers then becomes How can you discriminate between rising and falling securities?

The key is acknowledging and respecting price trends and profiting from the performance dispersion.

In order to do that, a logical, pragmatic, objective layer of “trend risk” control can greatly enhance risk management and maximize performance. Advanced and effective risk control is mandatory in this new market cycle. Conventional data, analysis, and investment tools are not designed to assess and validate price trends.

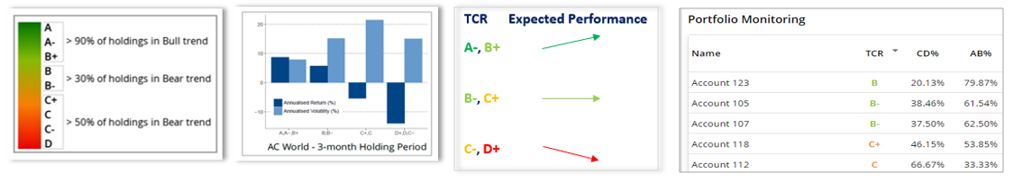

At Trendrating, we took on the mission to fill this gap by developing a multi-factor model that provides a rating of the actual medium-term price trends on stocks. As a result, it is now easy for asset managers to calculate and analyze the specific risk rating on their portfolios’ overall exposure to falling stocks. The larger the allocation to stocks in a down trend, the higher the risk of underperformance. Quite obvious and logical.

This introduction of the “trend risk rating” of portfolios adds an additional level of risk management for portfolio managers. The higher the portfolio rating the better the chances to outperform. The lower the rating, the bigger the risk of losses.

For example, a “B+” rating confirms that the trend exposure is safe as less than 25% of the holdings show a negative trend. On the other hand, a “C-“ rating signals that the allocation to falling stocks is in excess of 50%, presenting a high-risk structure.

The monitoring of the real-time, percentage exposure to falling stocks can provide an extra sanity check and spot in time an excessive exposure to down trends facilitating prompt adjustments toward safer selections and allocations. It offers a new paradigm and tool for portfolio risk control.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.