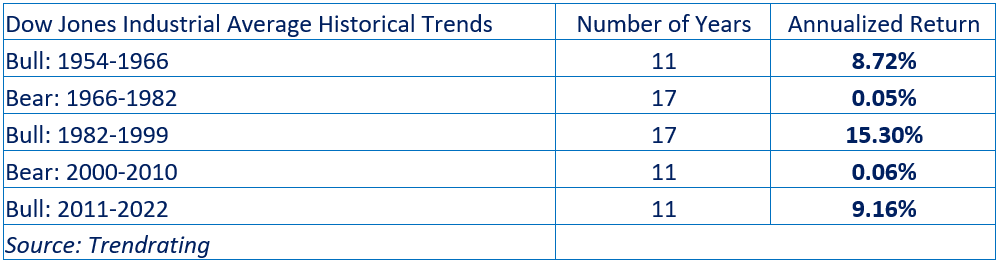

Stock markets entered in a new cycle in 2022. The experts call it “a new regime”, expected to generate low returns for the next few years. History can be of guidance here. After years of bull market a new cycle of low return usually last up to 11 years. Some statistics can offer an idea of what we can expect.

The bear cycles are characterized by years of sequential bear and bull waves, where the average yearly return from indices is well below 1%. But while the stock indices may prove to be disappointing, the performance dispersion across stocks offers opportunities to generate good returns. In 2022 the S&P 500 index posted a loss of around 17%, but the top 25% performers of the index recorded an average gain of 21%, and the bottom 25% lost on average 37%. If a series of up and down trends is the scenario ahead, then it is reasonable to anticipate mediocre returns from investing in passive strategies and index-linked products. Asset owners must reconsider the building blocks of the equity exposure. Active strategies, designed to exploit the performance dispersion across stocks in any market of interest, are the only solution to maximize the returns and grow the wealth well above the inflationary pressure that is here to stay. Profiting from dispersion on a consistent basis is not an easy exercise.

The key success factors required are: An up-to-date analytical framework to identify the opportunities and manage the risks. A process designed to react quickly to changes in the structure of dispersion. The ability to test, optimize and validate the investment decision process. Profiting from trends dispersion is all about capturing the outperformers and avoiding the underperformers in whatever investment universe selected. Conventional data, research and analytical tools exposed their limits in the bear trend of 2022. Discriminating between positive and negative price trends required advanced analytics and smarter insights. A new generation of models and leading-edge platforms are today available to add knowledge and enrich the information framework . The new cycle imposes to adopt any innovative tool that can offer an edge. For example the ability to measure and assess the portfolio exposure to falling stocks can help to limit the risk of losses. If a portfolio “trend risk allocation” shows an excessive weight on stocks in a bear trend, the high probability outcome is a severe underperformance. It is possible then to “rate“ the portfolios using this innovative risk metric and to spot the high risk situation in time to act.

In the new cycle the ability to promptly identify changes in the price trends of individual securities is key. Trends tend to be more extreme and fast . The use of adequate technology can enable to react faster to the new risks and opportunities that the market creates. Once defined the rules governing the investment process a “systematic execution” is safer than a discretionary implementation process.

How often we see assumptions, parameters, criteria, analytics that should support smart selection and allocation decisions, but at the end they prove quite poor at delivering the alpha we expect. Only a rigorous, objective historical testing of those ideas and rules can offer a factual assessment of the real value produced. The ability to stress-test any fundamental, quantitative and technical parameter is the basis of the critical insights that any investor needs. Interesting facts can be discovered, proving that a number of the assumed winning selection rules can disappoint. The opportunity to combine more parameters, checking more quality boxes and to discover the most productive combination is today available with systems of the new generation. A robust statistical evidence can offer the necessary documented evidence to confidently execute the chosen strategy.

Asset owners have the opportunity to gain a new perspective and reconsider the allocation strategy. Using innovative data and technology it is possible to reduce the dependency on passive products and discretionary, subjective active strategies. Building, optimizing and validating an active strategy, that check more quality boxes and can be executed in a systematic way, without human biases can well be the future. The benefits can be substantial. Improved returns, more disciplined risk control, full transparency, saving fees and time. Family offices that are not happy with the performance from accounts and funds managed by third parties can now empower themselves and be more in control of the wealth growth. Trendrating is a market leading provider of advanced analytics and technology for asset managers and asset owners, serving 250+ institutional firms on a global scale. Trendrating’s solution provides smarter insights on markets, portfolios and investment strategies. The technology supports a number of tasks including portfolio risk control, validation of investment ideas, allocation and optimization, design of model portfolios, active strategies and smart beta indices.

Source: Family Office Magazine & Events