About a month ago, we released a report on Global mining stocks highlighting how this sector, after a long decline, was beginning to see a change in fortune (see link). Over the last month, as the S&P 500 index (SPX) as returned 5.45%, the SPDR S&P Metals & Mining ETF (XME) and the Market Vectors Gold Miners ETF (GDX) have returned 29.27% and 11.01% respectively. On a YTD basis, these ETFs are now outperforming the SPX by over 39% and 49% respectively!

Smart Momentum analytics, as supplied by Trendrating, detects changes in momentum quickly and reliably, helping investors limit downside capture and protect profits in down markets while presenting positive momentum opportunities not to be missed by the discerning investor.

This report will utilize innovative momentum analytics to assess the current state of Global Mining stocks. We will analyze the effect of rating changes issued in the last month and assess how the ratings are performing in Mining subsectors.

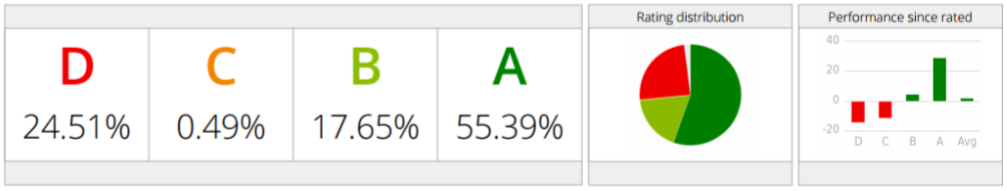

Rating Distribution:

Below is the current distribution of momentum in this sector as well as the average performance of each rating:

As we can see from the diagram, about 25% of Mining stocks are currently exhibiting negative momentum while about 55% of these stocks are in an established upward trend (A rated). A rated securities are out-performing D rated securities by an average of about 40% on a since rated basis. These statistics represents an improvement on our position a month ago.

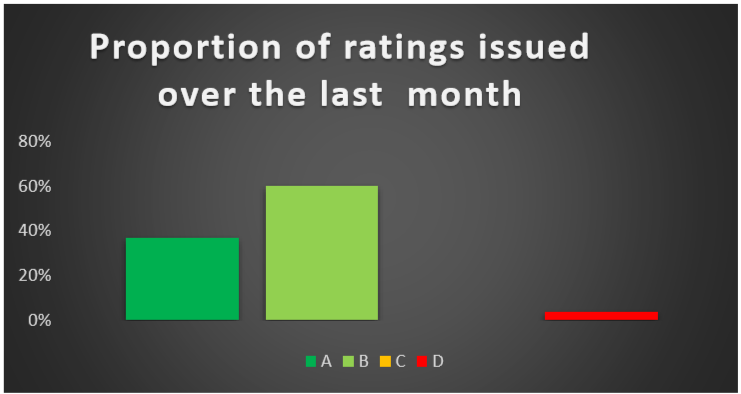

Recent Rating Changes:

The chart above displays the Momentum Ratings changes issued by Trendrating, over the last month, for Mining stocks with at least $2 billion in market capitalization. There were 29 Upgraded securities and 1 downgraded stock over this period. This means that 97% of issued ratings were for stocks moving into positive momentum (A and B ratings).

How have these recently upgraded securities performed since they were upgraded? The table below highlights the performance of the downgraded securities as well as some of the upgraded securities.

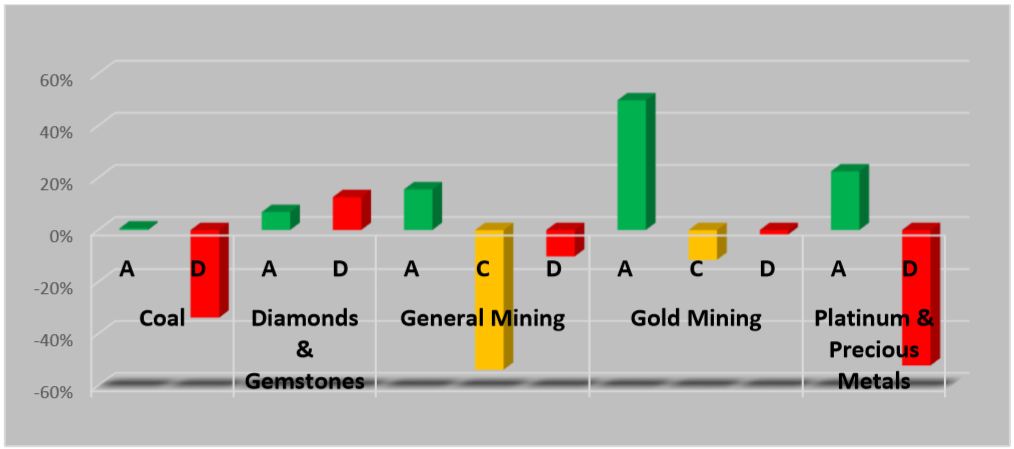

How are Trendrating’s momentum ratings currently performing among mining stocks?

The Chart above displays the average performance of stocks for each rating category in each mining subsector. We see that with an average return of about 50%, A- rated gold Gold mining stocks are our best performers. A rated stocks in each category generated positive returns on average. Negative momentum stocks, (C & D rated) on the other hand, have delivered negative returns on average. We can see extreme negative performance in General Mining, Platinum & Precious Metals and in Coal.

To conclude, in the last month, mining stocks have continued their positive start, producing returns that surpass most broad market indices over the last month. While Trendrating has generally continued to upgrade this sector, it is very telling that the negatively rated securities are still producing negative returns, dragging down the performance of investors holding on to these stocks.

Charts:

Below are some charts of positively and negatively rated commodities showing the timing of the most recent ratings

Positive Momentum:

Negative Momentum: