In a difficult year for global stocks, Gold Miners have been particularly strong performers. However, according to this recently published article on Bloomberg (see link) most funds missed out on this rally. On a YTD basis, GDX (Van Eck Vectors Gold Miners ETF) has returned about 84%. This compares to a 1.1% return delivered by the S&P 500 index and a -0.86% return by the MSCI World index. Missing out on rallies like this can have a detrimental effect on fund performance.

Smart Momentum analytics, as supplied by Trendrating, detects changes in momentum quickly and reliably, helping investors limit downside capture and protect profits in down markets while presenting positive momentum opportunities not to be missed by the discerning investor.

This report will utilize innovative momentum analytics to assess the health of Gold Mining Stocks. It will show that Trendrating’s momentum model caught the turn into positive momentum early, enabling suscribers to take advantage of this rally in gold miners.

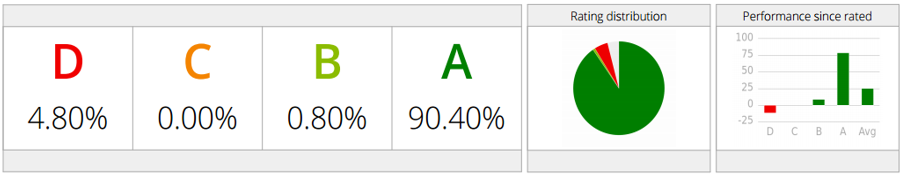

Rating Distribution:

Below is the current distribution of momentum ratings in all Gold Miners tracked by Trendrating:

As we can see from the diagram, over 90% of this universe is in a strong upward trend (A -rated). These stocks have returned over 75% since their latest positive rating! D -rated securities, on the other hand, are currently delivering negative performance, on average, in a market that is trending up strongly.

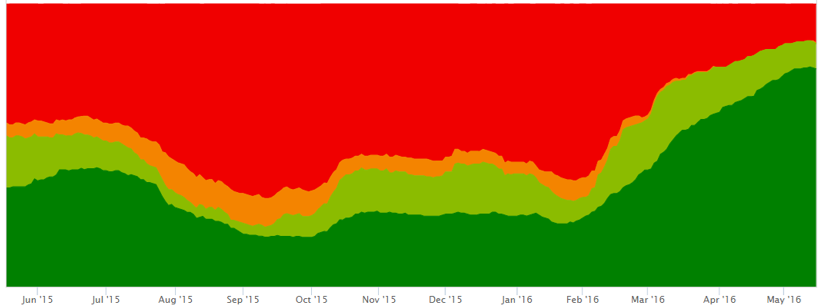

Evolution of Ratings:

The diagram above looks at the evolution of momentum in Global Mining Stocks, over the last year. We can clearly see that since October 2015, stocks in this sector have been moving into positive momentum. So far in 2016, we have seen an acceleration of this trend.

How are Trendrating’s momentum ratings performing in this universe?

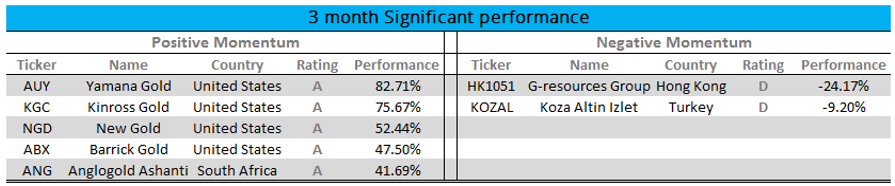

The table below highlights some stocks in positive and negative momentum, with significant performance over the last three months.

From the table above we can see examples of some A rated securities with spectacular returns over the last three months. We also see that the D rated stocks have delivered negative performance over the last three months.

To conclude, Gold Miners started moving into positive momentum in late 2015. This trend has accelerated over the last few months. Trendrating’s Smart Momentum Model was able to pick up these trends earlier and more reliably than legacy momentum models, allowing funds, using Trendrating, to profit from these trends.

Charts:

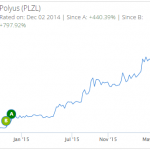

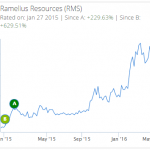

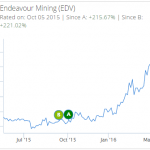

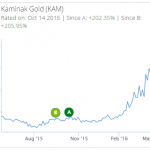

Below are some charts of positively rated Gold Miners showing the timing of the most recent positive ratings

Positive Momentum: