This report will utilise Trendrating’s Smart Momentum Analytics to assess the health of equity in developed markets and summarise momentum events in the last month. It will also suggest a strategic allocation across G7 Countries/ Sectors

MARKET OVERVIEW/ Market Breadth

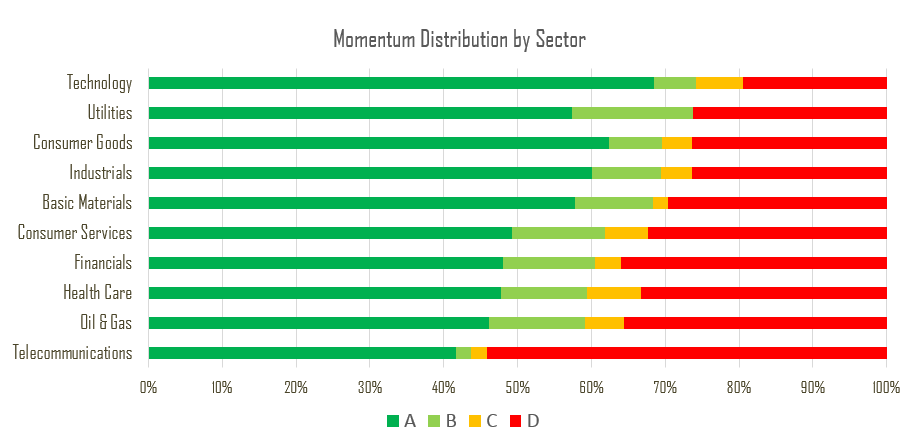

The Chart below analyses market breadth in Developed Markets Equity Sectors. Technology, Consumer Goods and Utilities currently present the best opportunities for spotting equities with positive momentum. Healthcare and Telecommunications sectors have the highest proportion of negatively trending stocks.

EVOLUTION OF SECTOR RATINGS OVER THE LAST MONTH

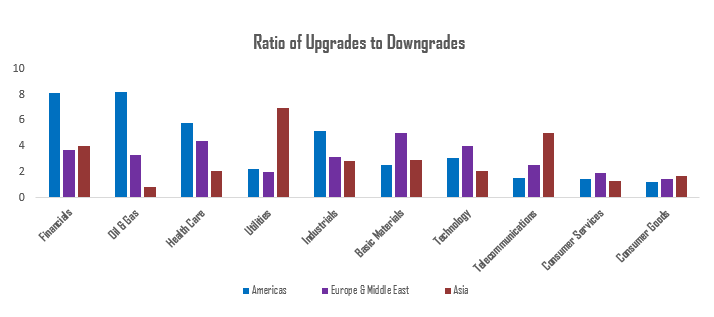

The graph above displays the ratio of Upgrades to Downgrades, in developed markets, for May 2016. We see that Financials and Oil & Gas driven by the Americas and Europe had the strongest turn to positive momentum for the month. On the other hand, Consumer Services and Consumer Goods had the highest proportion of negatively trending stocks over this period.

STRATEGIC ALLOCATION

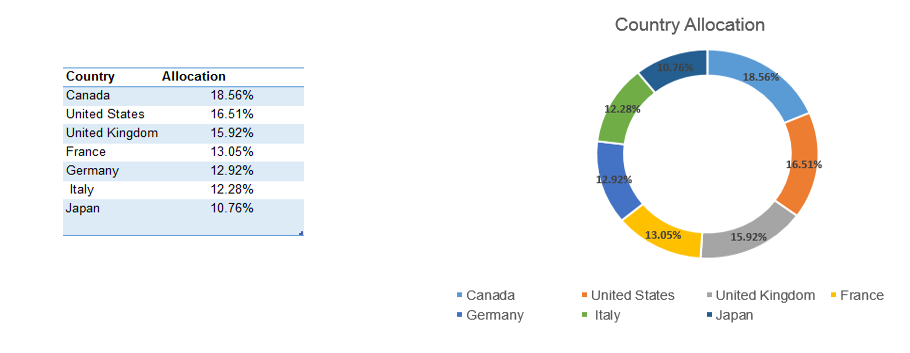

This section will use Trendrating’s Smart momentum analytics to answer the question: How should I be invested across G7 Countries? The Group of Seven (G7) are considered the world’s largest industrial nations and consist of Canada, France, Germany, Great Britain, Italy, Japan and United States.

Country Allocation:

- The model is advocating an overweight in North American Equity and an underweight in Japan and Italy

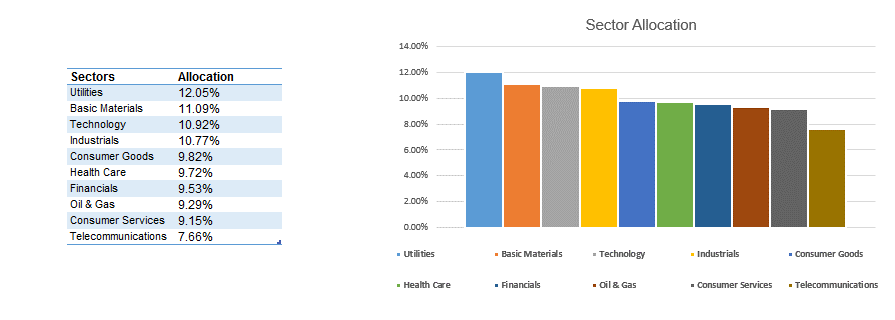

Sector Allocation:

- Utilities and Basic Materials are the high momentum sectors currently driving returns in G7 countries

- An underweight is recommended for Telecommunications and Consumer Services