The unprecedented speed of the 2020 bear market, coupled with the significant impact stemming from the selloff of ETFs and indiscriminate liquidation of stocks regardless of quality, has produced a unique, yet potentially fortuitous, situation for investors. To put things in perspective, the Dow Jones Industrial Average declined by 28.1% between 12 February and 17 March 2020, while the S&P 500 fell 35% from its 19 February 2020 all-time high (according to Bloomberg).

Eventually, however, the extreme volatility in financial markets will subside and conditions will start to normalize, with several industry experts pointing to a likely U-shaped, potentially even a drawn-out W-shaped, recovery curve. Select stocks will then start to rise, providing the opportunity to mitigate past losses. When this happens (the recovery that is, and it will!) and if history is any guide, capital will once more flock back into those stocks that satisfy − in our view – stringent criteria as active managers will start a sizeable rotation of their holdings to position for the market ahead.

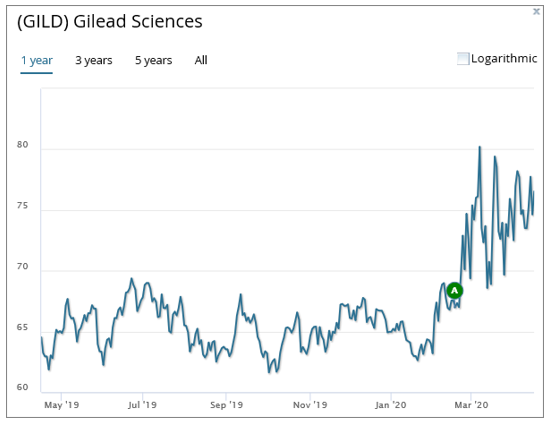

Yet, as investors continue to take stock and come to terms with the substantial losses experienced across a majority of listed securities globally, pockets of select stocks − such as in healthcare (see Figure 1), communications and information technology – continue to persist, exhibiting a remarkable resilience to the damage resulting from the COVID-19 pandemic. Not only are they holding up well, some names are trending up.

Figure 1: Stocks that prove to be resilient – Gilead Sciences Inc

Source: Trendrating as at COB 16 April 2020

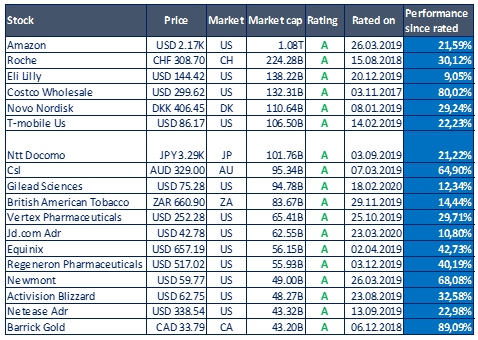

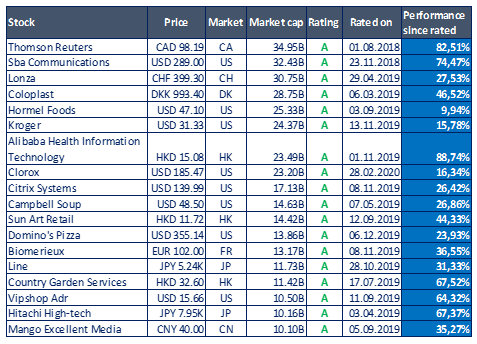

On that note, to better illustrate my point, we have pulled together a sample list of 36 select global stocks we are actively tracking and that continue to enjoy a rating of A (see Figure 2).

Figure 2: Tracking the Trend

Source: Trendrating as at 14 April 2020

But how can one be fully prepared to identify and capture these hidden ‘gems’?

The prevailing notion is that anchoring investment decisions in traditional fundamental research and thoughtful analysis should suffice to best position investors’ portfolios for potential risks and opportunities in markets. Such a traditional approach, however, may simply be no longer sufficient, especially when the dominance of money flow will likely be exceptional. Importantly, spotting where ‘big money’ will go requires the ability, i.e., the right tools, to be the first one out of the gate and capture trends well before analyst raise the outlook, and long before they become readily evident to the rest of the crowd. As John Stoltzfus, chief strategist at Oppenheimer Asset Management, observed in a recent interview on CNBC’s “Trading Nation”, looking at the current earnings season amidst the COVID-19 pandemic. “It’s going to show us winners and losers within the sectors — companies that may be positioned to weather this better.”

Active managers need to adjust to this increased level of volatility, rapid price stampedes and quick reversals. Risks and opportunities will likely emerge at a much more rapid pace, and reacting quickly to them will be detrimental. As Rocco Pellegrinelli, founder and CEO at Trendrating, observed in a recent interview, “Advanced analytics and new generation investment management technology are required to successfully handle the more challenging market environments we will likely face for the foreseeable future. Importantly, we believe price trend analytics can be applied neatly into any investment methodology, acting as another layer of intelligence and an overlay on a manager’s strategy.”

To review the complete list of bear-market-defying stocks and to explore Trendrating’s range of solutions, contact us at info@trendrating.net. Alternatively, you can conveniently schedule an in-depth demonstration.

Important Information

The evaluations, rankings and information provided by Trendrating (the “Services”) are provided solely for the use of finance professionals (the “Users”) who have been issued a license to use the Services by Trendrating and who, by nature of their status as investment professions understand, or are expected to understand, the complexity of finance products, the functioning of the markets and the risks inherent in them. The Services are not offered for use by persons not employed or actively working as professionals in the finance and investment industry. The Services are to be used entirely at the risk of the Users. Included in the Services are forward-looking statements that are based on observations, assumptions and calculations that reflect Trendrating’s expectations. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to materially differ from those expectations. The Services are not intended to constitute a recommendation of any specific security or financial product and are to be implemented solely in conjunction with or as part of a complete investment evaluation conducted by the Users. Under no circumstances shall Trendrating, its officers, directors, employees or agents be liable for any damages, lost profits or investment losses that result in any way from use of the Services or any interruptions, errors or delays in the Services. Trendrating S.A. © 2013-2020. All rights reserved.