A Fundamental Disconnect

Nearly 100 companies in the S&P 500 have withdrawn earnings guidance in this most recent earnings season, shining a light on just how uncertain the largest companies are about the Post-Covid economy. Others have cut dividends, suspended buybacks and laid off employees to preserve cash. This is anything but a normal economy. Amazon, JPMorgan and The Travelers Companies said as much in their most recent quarterly reports. This all leaves fundamental analysts with less certainty when predicting future cash flows. In this current market, it has become increasingly more important to combine fundamental research with trend analysis to get a clearer picture of the real value of a stock. Trendrating fills a critical gap by providing this missing level of intelligence.

– Rocco Pellegrinelli, CEO of Trendrating

June Sector Allocations

Methodology

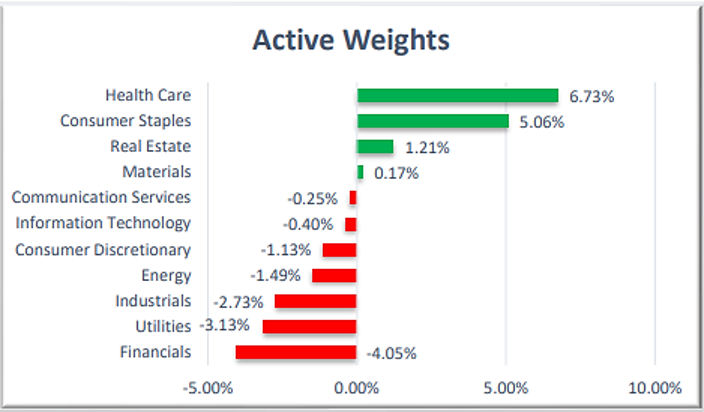

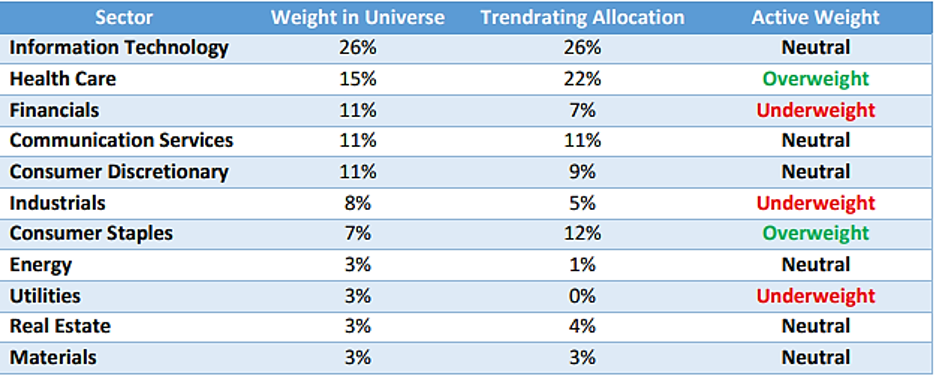

To arrive at our monthly Sector Allocations, we delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS). Any stock that has retraced at least 20% from a trend high is considered an outlier. The sector allocation is then found by looking at the proportion of names within quantile one for each sector. To control risk, no sector can represent more than double its weighting in the index.

Suggested Allocations

The companies and sectors that have held up the best over the last couple months remain most favorable. The Consumer Staples sector has the largest overweight, followed by Health Care, Communication Services and Real Estate. In contrast, Technology is now the largest underweight, followed by Financial, Industrials, Utilities, Energy and Consumer Discretionary. Our Model is neutral on Materials, which has a deviation of less than +/- 2% from the index weighting.

Top Trending Stocks in the S&P 500

Methodology

Each month we distribute the Trendrating 100 list to our clients. We delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS) and retracement value. Any stock that has retraced over 13% from a trend high is considered an outlier. This leaves us with a list of names in which our Model has high conviction. The market environment will dictate the number of names in the Top 100 list, but it will typically range from 80-100 companies. Here will be highlighting the Top 25 companies each month. Contact Trendrating for the complete list.

Trendrating Terminology

Rating Grade: A = Strong Bull Trend / B = Emerging Bull Trend / C = Emerging Bear Trend / D = Strong Bear Trend

Smart Momentum Score (SMS): is a continuous rating scale between -3 and 3, measuring the strength of the trend since that trend began. The metric allows the model to differentiate between securities of the same ratings, whether that is an A, B, C or D rated security.

Retracement: The percentage off the peak of the trend for positive trends or off the bottom for negative trends.

Additional Information

Proven Effectiveness – A 20-year back test supporting Trendrating’s sector allocation approach

Trendrating Brochure – An overview of the services we offer

Disclaimer:

ANY AND ALL INFORMATION PROVIDED BY TRENDRATING OR DERIVED FROM TRENDRATING’S DATA IS PROVIDED “AS IS” AND TRENDRATING MAKES NO WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Trendrating has no affiliation with any company mentioned in this report.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source: Nasdaq, Inc.