Price trends that can make a difference in the annual performance of an actively managed portfolio cannot be captured with metrics, analytics and research that disregards the impact of the big money flow in and out of individual stocks.

Fundamental analysis alone proves to be of little help to the mutual fund industry performance, where fundamentals and opinions are often the main foundation of the investment decision process.

Price trends are governed by a variety of factors in a more complex world. Rapidly changing economic scenarios, analyst sentiment, social media sentiment, momentum investing, and major firms using algorithms which create faster Money Flow, all contribute to the creation and acceleration of trends.

In the absence of specifically developed analytics and tools to pragmatically, objectively track and measure trends it is nearly impossible to profit from the performance dispersion. This poses a major risk to active managers who continue to underperform their benchmark to try to stop the outflow of assets into passive products. – Rocco Pellegrinelli, CEO at Trendrating

January Sector Allocations

Methodology

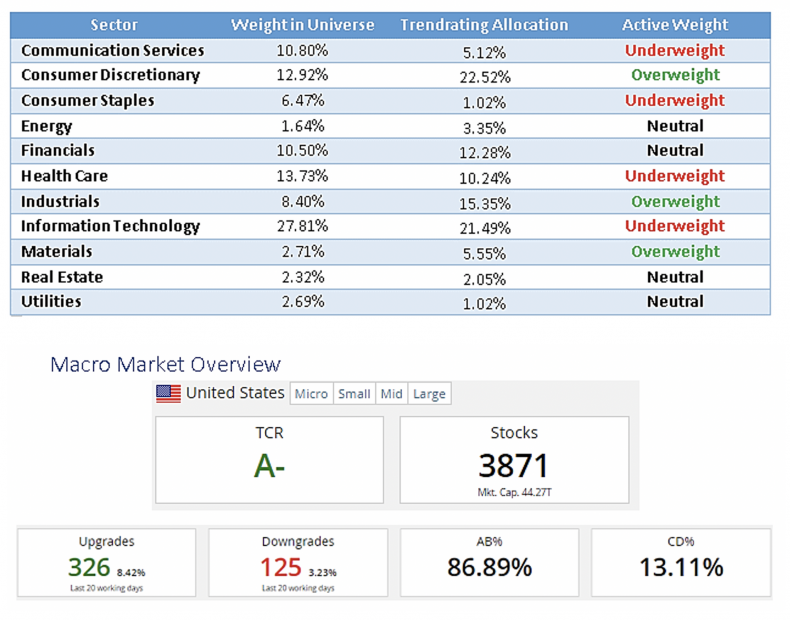

To arrive at our monthly Sector Allocations, we delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS). Any stock that has retraced at least 20% from a trend high is considered an outlier. The sector allocation is then found by looking at the proportion of names within quantile one for each sector. To control risk, no sector can represent more than double its weighting in the index.

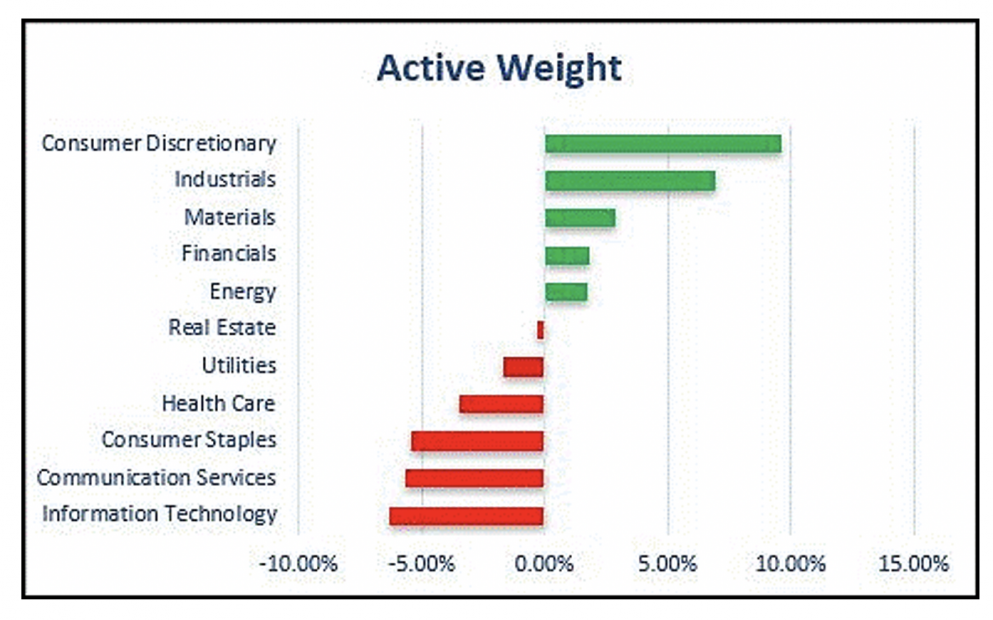

Suggested Allocations

Entering the new year has brought fresh uncertainty to the market. Currently, the Trendrating model is heavily overweight Consumer Discretionary and Industrials and has a slight overweight to Materials. Conversely, Trendrating identifies the sectors with the weakest trends as Information Technology, Communication Services, Consumer Staples, and Health Care. We are neutral on Utilities, Financials, Real Estate and Energy, which have a deviation of less than +/- 2% from the index weighting.

Methodology

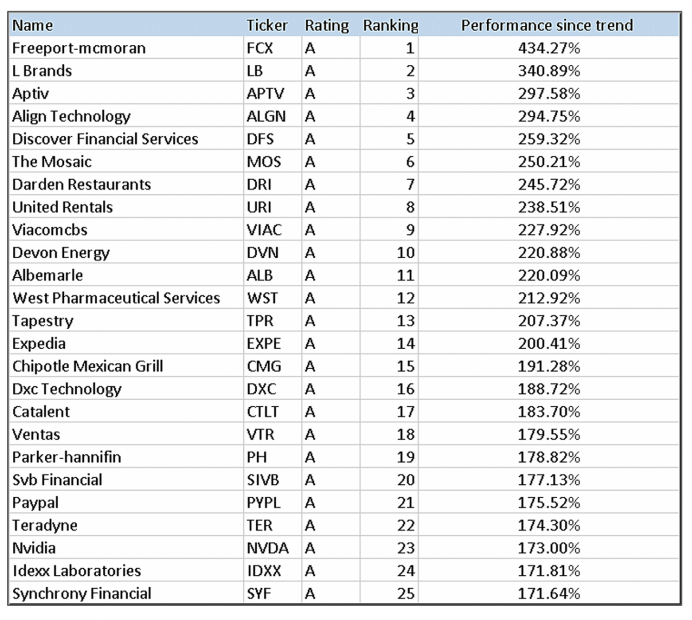

Each month we distribute the Trendrating 100 list to our clients. We delineate the S&P 500 universe of stocks into five groups based on their Smart Momentum Score (SMS) and retracement value. Any stock that has retraced over 10% from a trend high is considered an outlier. This leaves us with a list of names in which our Model has high conviction. The market environment will dictate the number of names in the Top 100 list, but it will typically range from 80-100 companies. Here will be highlighting the Top 25 companies each month. Contact Trendrating for the complete list.

Trendrating Terminology

Rating Grade: A = Strong Bull Trend / B = Emerging Bull Trend / C = Emerging Bear Trend / D = Strong Bear Trend

Smart Momentum Score (SMS): is a continuous rating scale between -3 and 3, measuring the strength of the trend since that trend began. The metric allows the model to differentiate between securities of the same ratings, whether that is an A, B, C or D rated security.

Retracement: The percentage off the peak of the trend for positive trends or off the bottom for negative trends.

Additional Information

Proven Effectiveness – A 20-year back test supporting Trendrating’s sector allocation approach.

Trendrating Brochure – An overview of the services we offer.

Pinnacle Trendrating Innovative Equity Fund (IPTRX) – A mutual fund utilizing our trend capture model.

Contact us to request more information about Trendrating’s web-based platform.

ANY AND ALL INFORMATION PROVIDED BY TRENDRATING OR DERIVED FROM TRENDRATING’S DATA IS PROVIDED “AS IS” AND TRENDRATING MAKES NO WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Trendrating has no affiliation with any company mentioned in this report.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source: Nasdaq, Inc.