More portfolio managers are realizing that combining an existing value strategy with the momentum factor does indeed improve risk-adjusted returns over the years. Trendrating’s unique long-term Momentum Model and Analytics Platform can quickly and easily overlay systematic and objective momentum ratings on top of any value strategy to smooth out returns across different market cycles.

Why Consider Combining Value And Momentum?

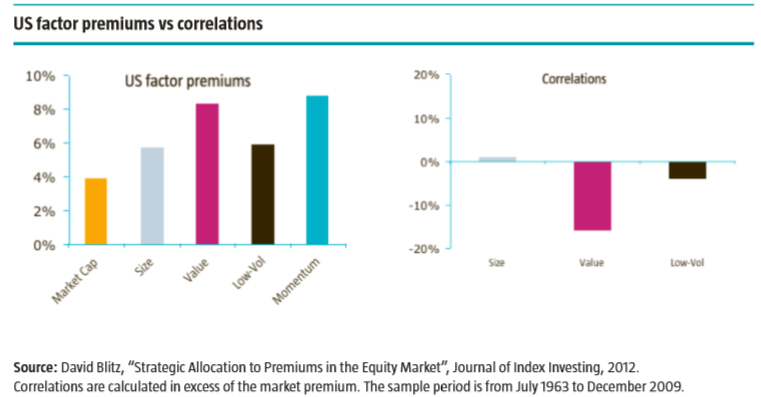

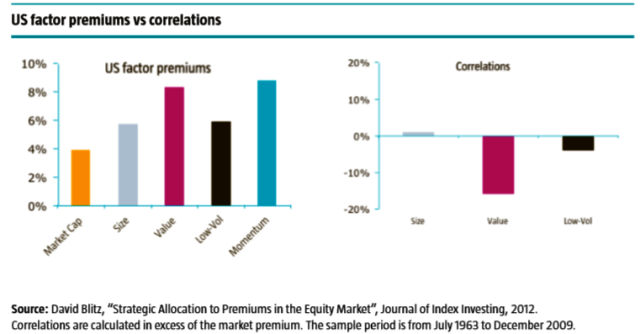

While proponents of both value and momentum investing appear to be at odds with one another, the negative correlation of the factors accounts for the reason they have proven to work best together. The negative correlation between value and momentum strategies coupled with their high expected returns make a simple strategy of equally weighting a portfolio with value and momentum stocks a powerful strategy that produces higher cumulative long-term rates of return than either value or momentum alone (across every asset class). In addition, the combination of value and momentum results in a significantly higher Sharpe ratio than either a value or momentum strategy alone and makes the portfolio less volatile across markets and time periods. The graphic below plots the returns of the market and a number of factors for US equities. Together with value, the momentum factor has the highest return, well above the market. In addition, the momentum premium exhibits a low correlation with low risk and value premiums. The figure below on the right shows that momentum is uncorrelated with the size, value and low-volatility factor premiums for US stocks. As a result, the diversification potential of momentum in a factor portfolio is expected to be significant. (*)

*Source: “Efficient factor-investing strategies”, Blitz, Huij, Lansdorp and Pim van Vliet (February 2013).