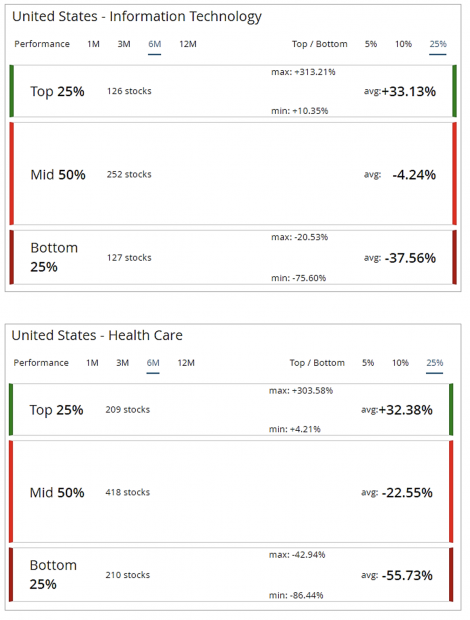

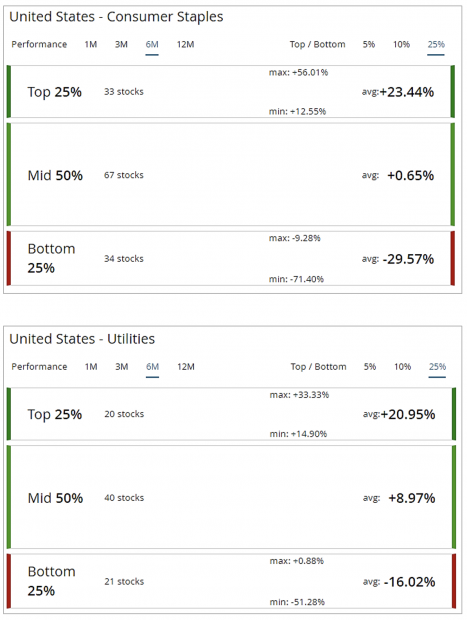

The performance dispersion across any investment universe is a gold mine for active investors that have the right tools to profit from it. The ability to “identify and capture” some of the top 25% performers can make a big difference. It is possible to gain an edge using intelligent “trend validation” analytics.

At Trendrating we like to track and document the performance dispersion, a valuable insight for active managers. Our unique rating methodology can contribute to profiting from the dispersion.

Price trends are more extreme and last longer than in the past as they are impacted by several factors of which company fundamentals are only a small part. Money flow caused by major firms, analyst sentiment, social media sentiment, momentum players, and an economic landscape full of uncertainty and fast changing scenarios all contribute to creating and accelerating price trends in either direction that fundamental-driven methodologies cannot capture.

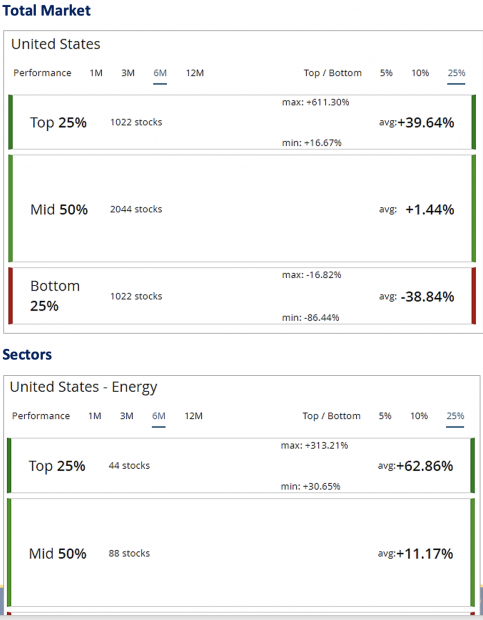

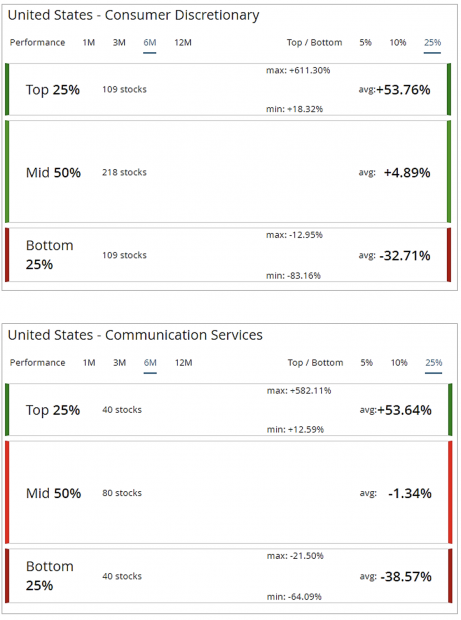

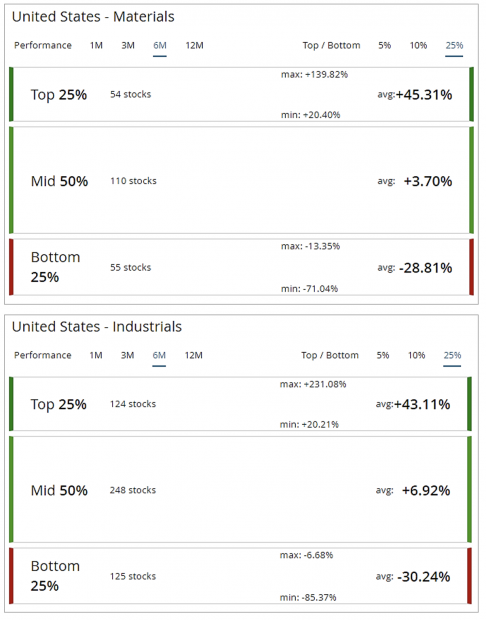

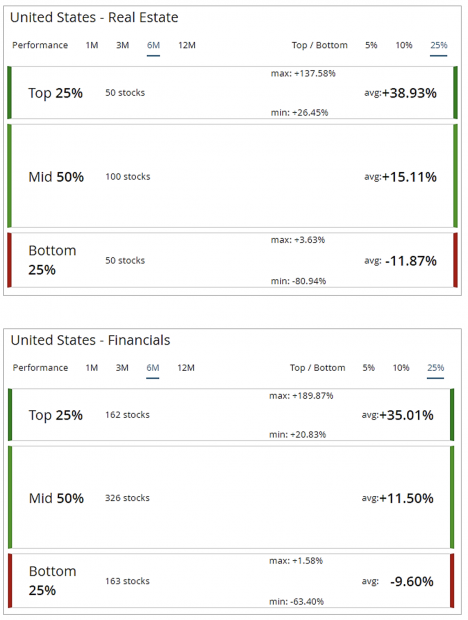

Each month we publish a report exposing the statistics across US sectors. Here is the last 6 months performance dispersion for the US market.At the end of July, the best average profit opportunities in the top 25% of best performing stocks were available in Energy, Communication Services and Consumer Discretionary. Narrower dispersion was found in Consumer Staples, Utilities and Health Care.

Additional Information

Trendrating Use Cases – An overview of the services we offer

Trendrating Indices – Six Indices calculated daily and rebalanced monthly.

ANY AND ALL INFORMATION PROVIDED BY TRENDRATING OR DERIVED FROM TRENDRATING’S DATA IS PROVIDED “AS IS” AND TRENDRATING MAKES NO WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. LEARN MORE ABOUT TRENDRATING AT WWW.TRENDRATING.COM OR CONTACT INFO@TRENDRATING.COM.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source: Nasdaq Inc.