Early this year, we released a report on European Banks urging investors to be wary as this sector was trending negatively (see link). In that report, we highlighted five negatively rated banks with bad performance. Seven months later, having to contend with a low interest rate environment and increased regulatory scrutiny, all five banks are still negatively rated and have delivered terrible returns. One, Banca Mps, is now down over 95% since the negative rating was issued!

Trendrating’s Smart Momentum analytics is an essential risk management tool for the discerning investor. It quickly and reliably detects changes in long term momentum, helping to limit drawdowns while presenting positive momentum opportunities even in seemingly bearish market environments. Put simply, Smart Momentum helps us make better investment decisions.

This report will utilise innovative momentum analytics to assess the current state of European Banks.

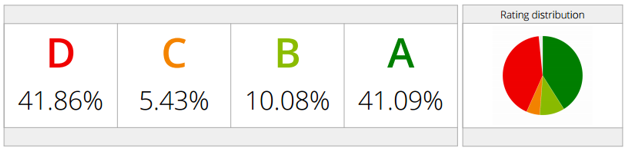

Rating Distribution:

Below is the current distribution of momentum among European Banks :

We see a fairly even split between positively and negatively rated securities. The average performance of each rating category however tells an interesting story.

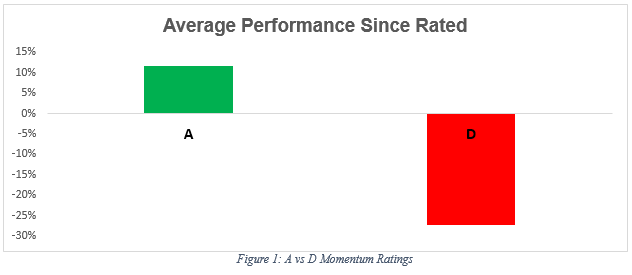

Rating Performance:

From Figure 1 above, we see that A rated securities are providing positive performance while D rated banks are dragging down the performance of this sector. On average, A rated securities are out performing their D rated counterparts by 40%. The Trendrating Smart Momentum model has done a great job of picking winners and losers in a difficult environment.

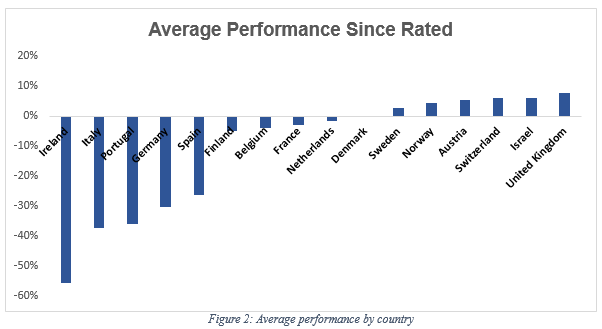

Rating Performance by country:

When we view the performance of banking stocks by country, we see that Banks in Ireland, Italy, Portugal and Germany are the worst performers while those in the UK, Switzerland and Israel have relatively good performance.

Conclusion:

Trendrating Smart Momentum analytics has reliably seperated winning and losing stocks in European Banks, allowing investors to better manage risks and spot new investment opportunities.

Below are some charts of positively and negatively rated European Banks showing the timing of the most recent ratings.

Negative Momentum:

Positive Momentum: